NY Cannabis Market: Progress and Challenges

The New York State Office of Cannabis Management recently released a three-year study report detailing the progresses and challenges faced since the enactment of the Marijuana Regulation and Taxation Act (MRTA). This comprehensive report highlights both strides and stumbles in New York’s burgeoning cannabis market.

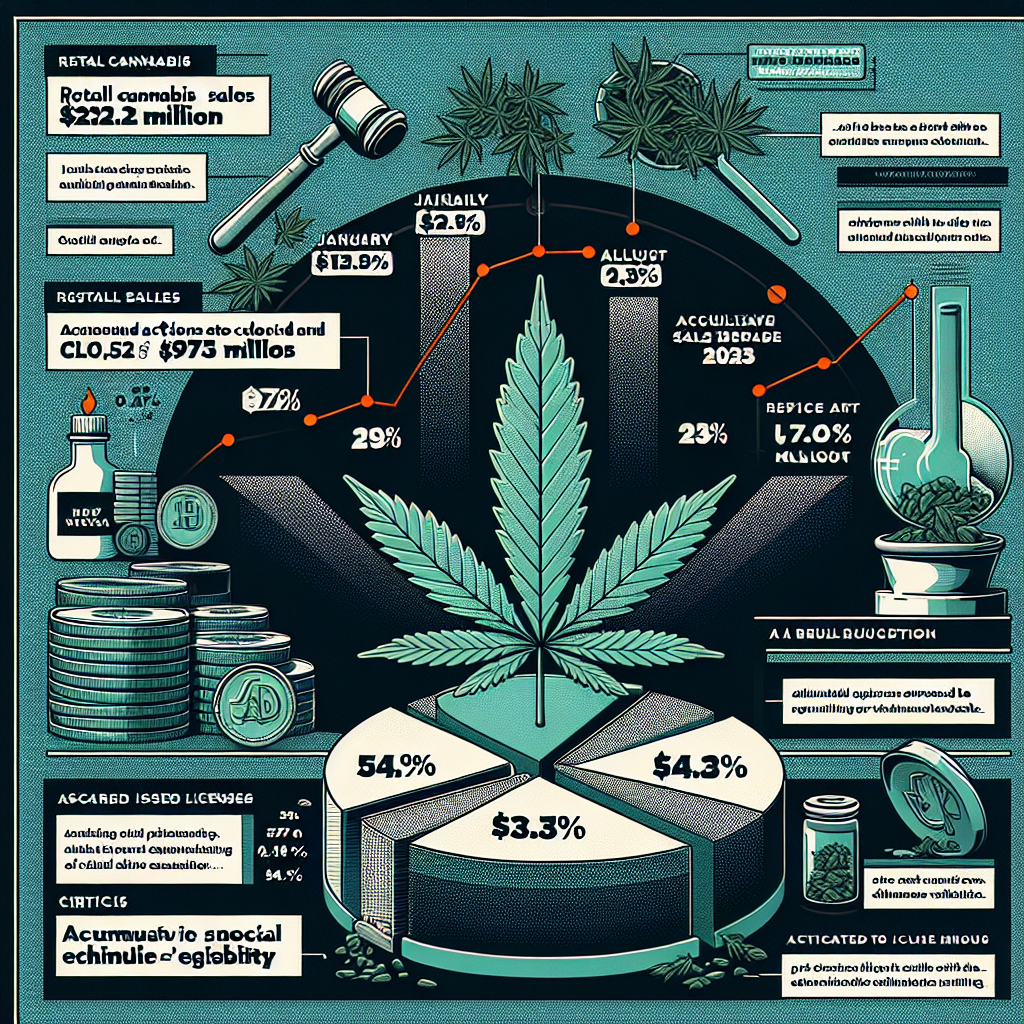

A standout feature of the report is the economic growth witnessed since legalization. Retail cannabis sales have surged impressively from an initial $2.2 million in January 2023 to $97.4 million by August 2024, accumulating over $653.9 million in total sales. This boom reflects a growing acceptance and integration of cannabis within local economies.

In terms of licensing, the state has issued over 1,300 adult-use cannabis licenses, a significant number considering the regulatory hurdles often associated with new markets. Among these, 54.7% have been awarded to ‘social and economic equity-eligible’ applicants, surpassing the state’s target. This focus on social equity aims to rectify past disparities caused by the War on Drugs and provide opportunities for those historically marginalized.

On public health, there’s a concerted effort to track and improve safety and health standards across the industry. Despite these positive trends, the report doesn’t shy away from discussing the operational challenges and the persistent black market, which competes against the legal market with cheaper, but unregulated products.

Another focal point of the study is the operational capabilities and upcoming projects expected to fortify market operations and compliance. The state has taken rigorous actions to close down illegal vendors, as evidenced by the closure of over 1,000 illegal stores in New York City as part of the ‘Operation Padlock to Protect’ initiative, leading to the seizure of vast amounts of illegal products valued at approximately $68 million.

Equally important is the criticism over the management of the Office of Cannabis Management, with calls for improved clarity and administration to foster a thriving legal market. The regulatory framework and oversight are pivotal for a mature market that ensures consumer safety and efficient business operations.

All things considered, this comprehensive report illustrates New York’s serious commitment to not only cultivating a thriving economic front but also addressing social injustices of the past through an inclusive and regulated cannabis industry. However, there are clear indicators that the path forward requires adjustments and more robust frameworks to combat the challenges encountered during these initial stages of legalization.

The state’s progress and its dedication to refining the cannabis industry’s landscape highlight an essential model of how legalization can potentially unfold in other regions, balancing economic growth with social responsibility.